does nj offer 529 tax deduction

Minimum subsequent contributions are 25 and less with payroll deduction or the automatic plan. 52 rows Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits.

Grow Your Tax Awareness J P Morgan Asset Management

College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs.

. Unlike many states the IRS does not provide a current tax deduction for. Contributions to such plans are not deductible but the money grows tax-free while it. Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college.

Unfortunately New Jersey does not. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer. Currently you can contribute to your New Jersey 529 plan until the.

The Vanguard Group Inc serves as the Investment Manager and. Only offered to account owners and their spouses. New York Can deduct up to 5000 per year per person.

A 529 plan technically known as a qualified tuition program under Section 529 of the Internal Revenue Code is an education savings plan that provides major tax advantages said Gene. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of. New Mexico All contributions to in-state 529 plans are deductible.

The Federal Tax Cuts and Jobs Act TCJA which was signed into law in December 2017 and became effective January 1 2018 expanded the definition of a qualified higher education. Investments in other states 529 plans are not eligible for either the dollar-for-dollar state grant to match up to 750 of the initial contribution to a new NJBEST account nor the. Thanks to recent legislation however you may now be able to deduct up to 10000 of annual contributions you make to New Jerseys 529 plan the New Jersey Better.

529 Tax Benefits for New Jersey Residents New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan.

529 College Savings Plan Options Broken Down By State

What Are The 529 Plan Contribution Limits For 2022 Smartasset

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

Does Your State Offer A 529 Plan Contribution Tax Deduction

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

The New Jersey 529 Plan Everything You Need To Know

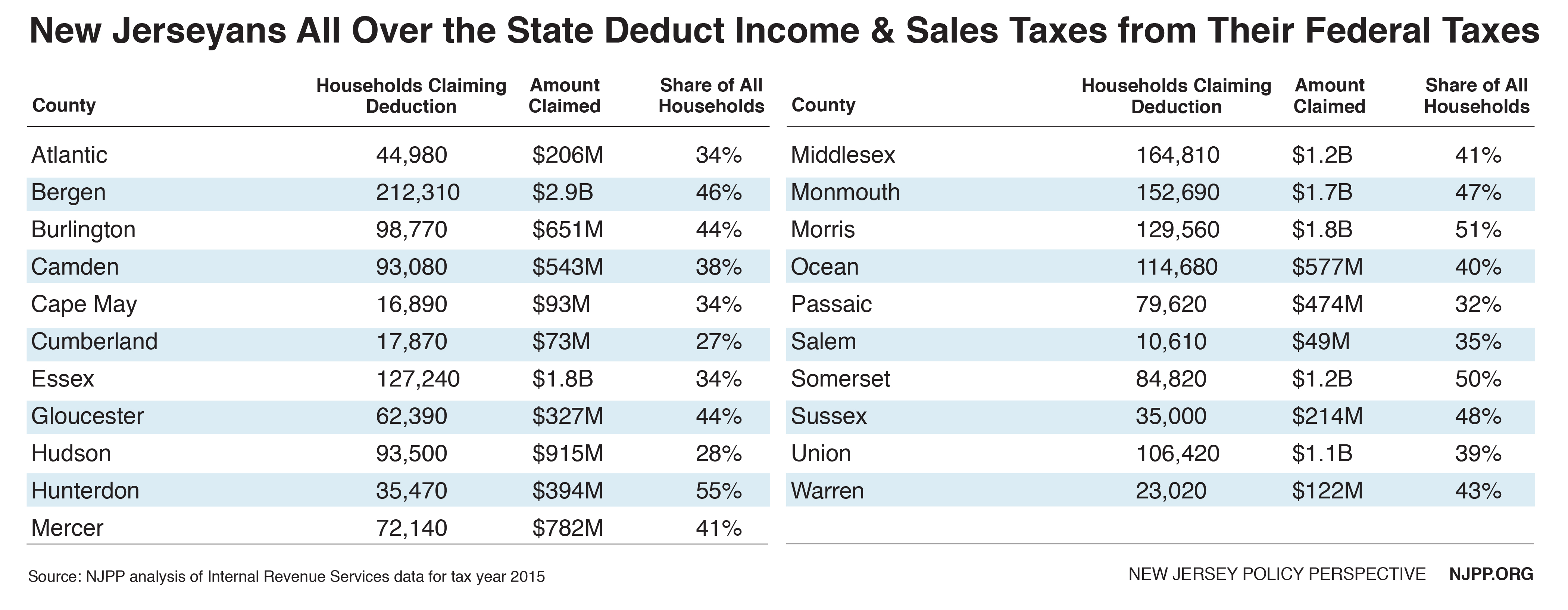

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each Year New Jersey Policy Perspective

Clueless About 529 Plans Here S A Guide Nj Com

529 College Savings Plan Options Broken Down By State

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

Direct Portfolio College Savings Plan Colorado 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Saving For College 529 Plans Versus Everything Else

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

529 Plan Maximum Contribution Limits By State Forbes Advisor

Nj Tax Treatment Of 529 Plan Earnings Njmoneyhelp Com

States That Offer 529 Plan Tax Deductions Bankrate

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Education Savings Accounts Coverdell Esa Vs 529 Plans Vision Retirement

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time